On 25 September 2018, the RIPE NCC passed the milestone of 20,000 Local Internet Registries (LIRs). We look at what's happened since the previous milestone of 15,000 LIRs and share our thoughts about the future: how much time is left for the IPv4 pool, and what are the prospects for membership developments?

LIRs Over Time

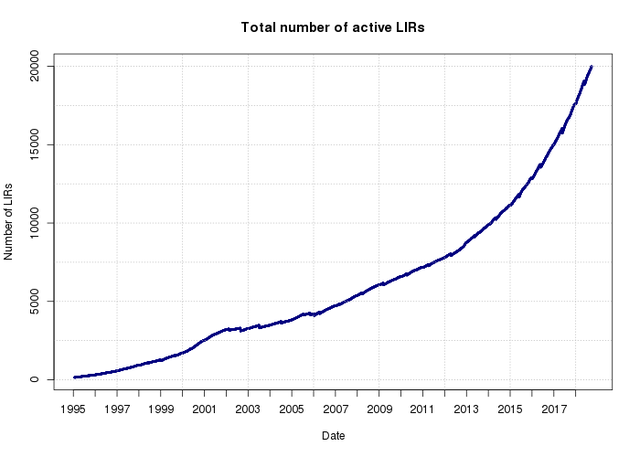

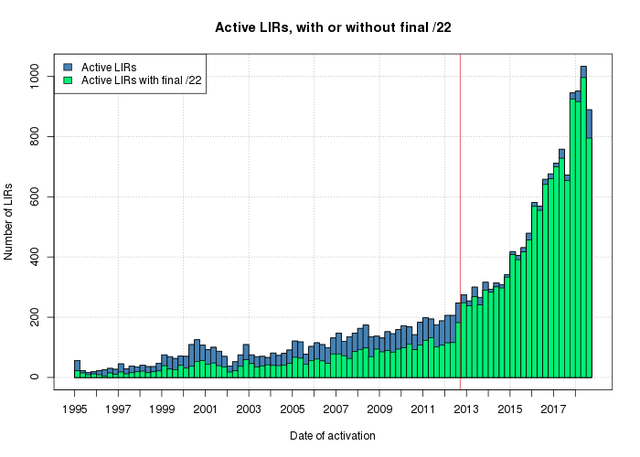

The number of RIPE NCC LIRs has been growing rapidly since we reached the last /8 of IPv4 address space on 14 September 2012. At that time, the number of active LIRs stood at 8,320. 17 months later, on 18 February 2014, the 10,000 LIRs milestone was reached; this meant an average growth rate of about 100 new LIRs per month. In the next 34 months, the number of active LIRs grew by another 5,000; we reached 15,000 LIRs on 28 December 2016. And now, only 21 months later, we are looking at 20,000 active LIRs. The increasingly shorter periods between these milestones indicate that growth has been accelerating in the last five years; this is also clear when we plot the total number of LIRs over time, as shown in Figure 1 below.

Figure 1: Evolution of the number of active RIPE NCC LIRs

However, the reported growth is always the net growth; next to new LIRs opening, we also have existing LIRs closing, whether by request from the member or by the RIPE NCC. Reasons for closure vary and are outlined in the Closure of Members document. Throughout the year there is a steady trickle of accounts closing, too small on a day-by-day basis to be seen in the graph. What is visible, however, are the annual dips towards the end of May, when members who failed to pay their membership fee have their service agreement terminated.

Looking in detail at the developments in the past two years, we observe the following changes since we reached the 15,000 LIR mark:

- 6,150 new LIRs activated

- 1,100 active LIRs closed

- 75 active LIRs set to pending closure

Pending closure is an administrative state between being active and being fully closed. The member had their service agreement terminated, but the process of deregistering resources is still ongoing. Some of the members who fail to meet the 120-day payment window at this stage opt to re-open the account by paying the re-opening fee as well as all outstanding invoices; others will close fully.

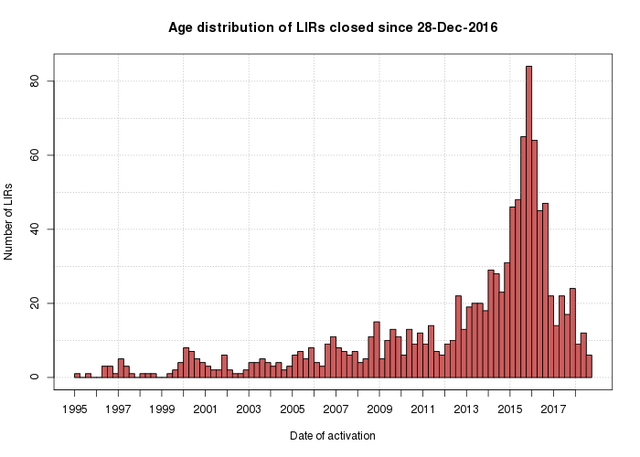

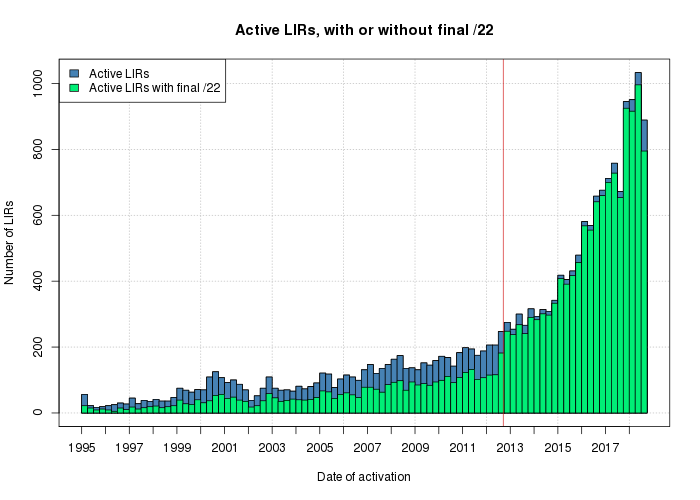

When we check the LIRs that closed since the 15,000 LIR milestone was reached, we find many of them orginally opened in 2015 and 2016; figure 2 illustrates this. As these were years of rapid growth, it is not too strange to see more closures from LIRs activated in the 2015/2016 time period. But in relative terms, the ratio is still higher than expected. This is something that very likely relates to the RIPE community's policy for IPv4 allocations from the last /8. Since the amendments introduced by Policy Proposal 2015-01 (adopted in July 2015), allocations received from the RIPE NCC cannot be transferred to another LIR within the first 24 months. So LIRs that opened in the second half of 2015 could only start considering transfer of their final /22 allocations from the second half of 2017 onwards. LIRs that opened in the last quarter of 2016 or later do not have the option to transfer the IPv4 allocation yet; as expected, closure rates drop steeply for these most recent quarters.

Figure 2: LIRs closed since reaching the 15,000 LIR milestone, grouped by their activation date

LIRs vs. Members

A major factor contributing to the accelerating growth is the opening of additional LIR accounts by existing members. While it has always been possible for an organisation to hold more than one LIR, the total number of additional accounts was rather limited in the first 20 years of the RIPE NCC's history. In most cases, this happened when, through a process of mergers and acquisitions, originally unrelated businesses had come under control of a single legal entity. For administrative reasons, the respective LIR accounts often were kept open, each with the originally allocated resources. IPv4 was not rationed yet and allocations and assignments were made on basis of demonstrated need. Therefore it made no difference to either the RIPE NCC or the IPv4 pool if different business units of the same company used a shared LIR account or each operated an LIR of its own.

This situation changed significanlty when we reached the last /8. The policy developed and accepted by the RIPE community entitles every LIR to one and only one final /22 IPv4 allocation. By opening additional LIRs, it is possible for a single organisation to obtain more than one /22. In 2014/2015, the first signs appeared of this route gaining popularity. It prompted the community to put in place the 24-month hold period for transfers. Forcing members to keep LIRs open for at least two years increased the costs for those who, after opening a new LIR, quickly transferred the /22 allocation and closed the account again (often in the same quarter). In November 2015, the RIPE NCC Executive Board decided to temporarily freeze creation of addtional LIRs. However, after carefully weighing all pros and cons gathered during the moratorium, the RIPE NCC membership at the May 2016 General Meeting decided to lift the restriction and allow multiple accounts again. It was preferred to have these relationships clear and in the open rather than have organisations set up new legal entities which each would apply for RIPE NCC membership of their own.

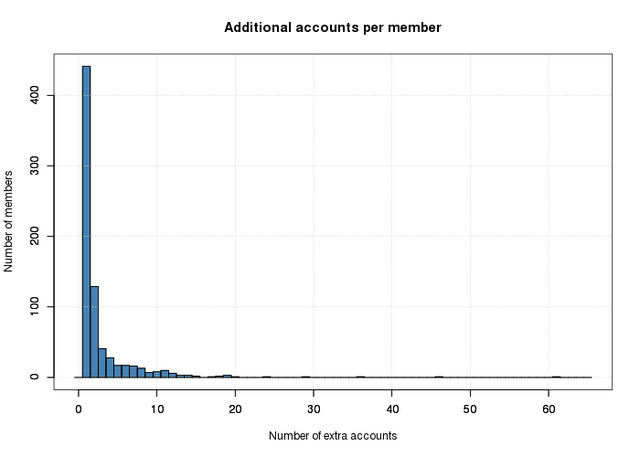

Figure 3: Distribution of additional accounts per member

Since the ability to create additonal LIRs was restored, the difference between the number of members and number of active LIRs has been increasing steadily. Of all new LIRs that were opened after reaching the 15,000 LIR milestone, 30% are additional LIR accounts. In terms of members, unique legal entities, 4,260 new ones joined the RIPE NCC and 990 were closed. While the LIR count has now passed the impressive 20,000 active account milestone, the number of members sits just below the 18,000 mark. Figure 3 shows the distribution of additional accounts per member. This ranges from - in the majority of cases - one or two additional accounts to 20 or more for a small number of members.

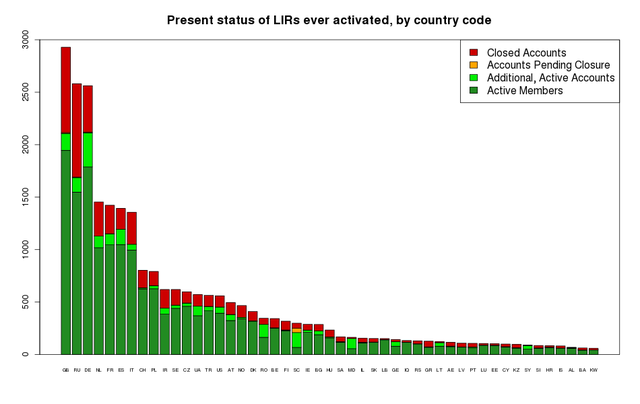

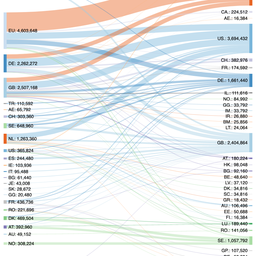

When we look at all LIRs ever opened, grouped by the country where the member is incorporated, a similar picture emerges; in some countries additional LIRs are more common than in others. As Figure 4 shows, organisations in the United Kingdom have set up the most LIRs, but they also closed the most LIRs; the total now active in the country is lower when compared to Germany. In terms of unique members, however, the UK is still number one by a fair margin.

Figure 4: Top 50 countries by LIRs ever opened. The colours represent the present state: active member, active additional account, pending closure and closed accounts.

Reasons for Joining

Receiving a final /22 allocation seems to be the main reason for opening an LIR account. Most of the LIRs activated under the last /8 policy have received a final /22 allocation. Figure 5 below groups the LIRs by the date they were activated. For each quarter, the blue bars show how many were activated, while the green bars show how many received the final /22 they are entitled to. The change in behaviour for LIRs that opened after 14 September 2012 when the RIPE NCC reached the last /8 is very apparent. Where about 55% of the old LIRs, established before this date, have requested the final /22 allocation, the figure jumps to 96% for LIRs established after the IPv4 policy change came into effect.

Figure 5 also shows how, since October 2012, every quarter sees a (small) number of newly activated LIRs who do not request their final /22 allocation. Except for LIRs that opened in the last quarter, who could have the request in the pipeline, LIRs that never asked for their IPv4 allocation may have been established to request IPv6, to be able to receive a transfer or to bring legacy resources into the registration system.

Figure 5: Distribution of all active LIRs and LIRs that received their final /22. The red line marks the day we reached the last /8.

How Long Before the IPv4 Pool is Empty?

When we reached the 15,000 LIR milestone, extrapolation of the then current trend led us to a projected run-out date in the middle of 2021. However, as growth in the number of LIR accounts accelerated, allocation of final /22s reached levels we did not anticipate. By April 2018, the last /8 allocated by IANA in February 2011 had been used completely and we started to allocate from address space recovered by the RIPE NCC itself.

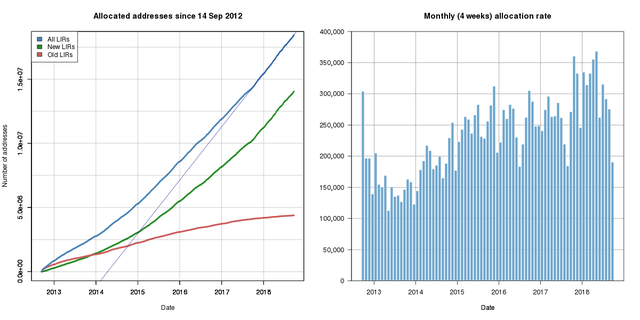

Figure 6a and 6b: Evolution of total allocated IPv4 addresses under the "last /8" policy and the 4-weekly allocation rate.

Figure 6a plots the address space allocated after reaching the last /8 as a function of time, showing both the total and the split in old vs. new LIRs. It also shows how a linear fit to the most recent data, the straight line, fails to match growth in earlier years. When we turn to a quadratic fit, the match is much better, though still not perfect. As Figure 6b illustrates, the allocation rate fluctuates highly, even when aggregated to periods of four weeks.

If the present, accelerating growth continues and no significant amounts of IPv4 addresses come back to the pool (from deregistration), extrapolation of the quadratic fit leads to a projected run-out date in early June 2020 with a statistical uncertainty of +/- three weeks. On the other hand, should growth in allocations stabilise in the next two years, and be better matched by a linear model, the IPv4 pool would last a little longer, to August 2020. The statistical uncertainties in that fit, however, are much larger; the fluctuating allocation rate means a high spread in solutions to the linear fit. What both models do agree on is that the IPv4 pool will very likely empty in a timespan of 20-26 months from now, before the year 2020 is over.

Membership Projections

As Figure 6a illustrates, the final /22 allocations these days almost exlusively go to new LIRs. Older LIRs that were established before the last /8 policy came into effect and still have not requested their final allocation might not need this or they might not be aware of the policy. Since each LIR can only receive one /22, this means the approximately 7,650 /22 allocations left in the pool will more likely than not go to new LIRs. Taking into account that about 4% do not request the /22 they are entitled to (see Figure 5), we can expect almost 8,000 new LIRs to be activated in the next two years. At the same time we will have LIRs closing, probably at higher rates than before, because members with more than one LIR can merge the additional LIRs into another account once the 24-month hold period on the IPv4 allocation is over. While exact numbers cannot be known, a scenario where all present additional accounts close and another 500 single-LIR members per year close for various reasons would see around 3,000 LIRs closing between now and the end of 2020. That would leave around 25,000 active LIRs at the start of 2021.

Since the prospect of receiving a /22 of IPv4 appears to have been the main reason to open a new LIR, we can expect growth rates to drop significantly once the IPv4 pool empties. This could potentially be compensated somewhat by an increase in the number of organisations that become a member and open an LIR to receive a transfer. How large those numbers will be is hard to predict; all depends on how the transfer market will develop and how many of the recipients are not a member of the RIPE NCC yet. In the years immediately following run-out, it is likely that we will see LIR accounts that opened in 2019 or 2020 in order to get more than one /22 close completely. Exact numbers again are hard to forecast, but to give some idea, if half of the to-be-established accounts that will receive a final /22 close before 2023, the numbers could be back at the 20,000 mark again in four years time.

Summary

Growth in LIRs in the past two years has been exceptional and unprecedented, partly because an increasing number of members open a second or third LIR account. As most of the new LIRs request their final /22 IPv4 allocation, the steady increase will cause the IPv4 pool to be emptied in roughly two years time. The number of active LIRs may peak at or above the 25,000 mark. After that, we expect the number of active LIRs to start to decrease as more existing accounts will close than new ones are opened.

Comments 0

The comments section is closed for articles published more than a year ago. If you'd like to inform us of any issues, please contact us.